- Title: Social Capital, Trust, and Firm Performance: The Value of Corporate Social Responsibility during the Financial Crisis

- Authors: Karl V. Lins, Henri Servaes, and Ane Tamayo

- Publication: The Journal of Finance, Vol. LXXII, No. 4, August 2017

The present financial crisis springs from a catastrophic collapse in confidence. . . Financial markets hinge on trust, and that trust has eroded.

—Joseph Stiglitz (2008)

What are the research questions?

There is little to no research on the degree to which, or even if, stock price performance during a crisis is related to the amount of trust and social capital (CSR) attributed to a company. The World Business Council for Sustainable Development (2000), defines CSR as ”…the commitment of a business to contribute to sustainable economic development, working with employees, their families, the local community and society at large to improve the quality of life.”

The impact of these corporate practices are the central theme of this study. The performance of 1,673 nonfinancial firms is analyzed over the period August 2008-March 2009. The MSCI ESG database is used to extract variables as indicators of social capital. Research suggests that the corporate social responsibility (CSR) practices of firms does create trust and social capital in the minds of investors. Data on geographic regions was obtained from the 2006 General Social Survey at the University of Chicago. Survey data was gather by the National Opinion Research Center, indicating regions where individuals are more or less trusting.

- Was there a difference between the price performance of stocks with high ESG ratings versus low ESG ratings, during periods of financial crisis?

- Is there evidence that stakeholders (especially investors) show commitment to help and cooperate with trusted firms during periods of crisis? Is this commitment related to the ability to raise funds, profitability, margins and/or other productivity measures?

What are the Academic Insights?

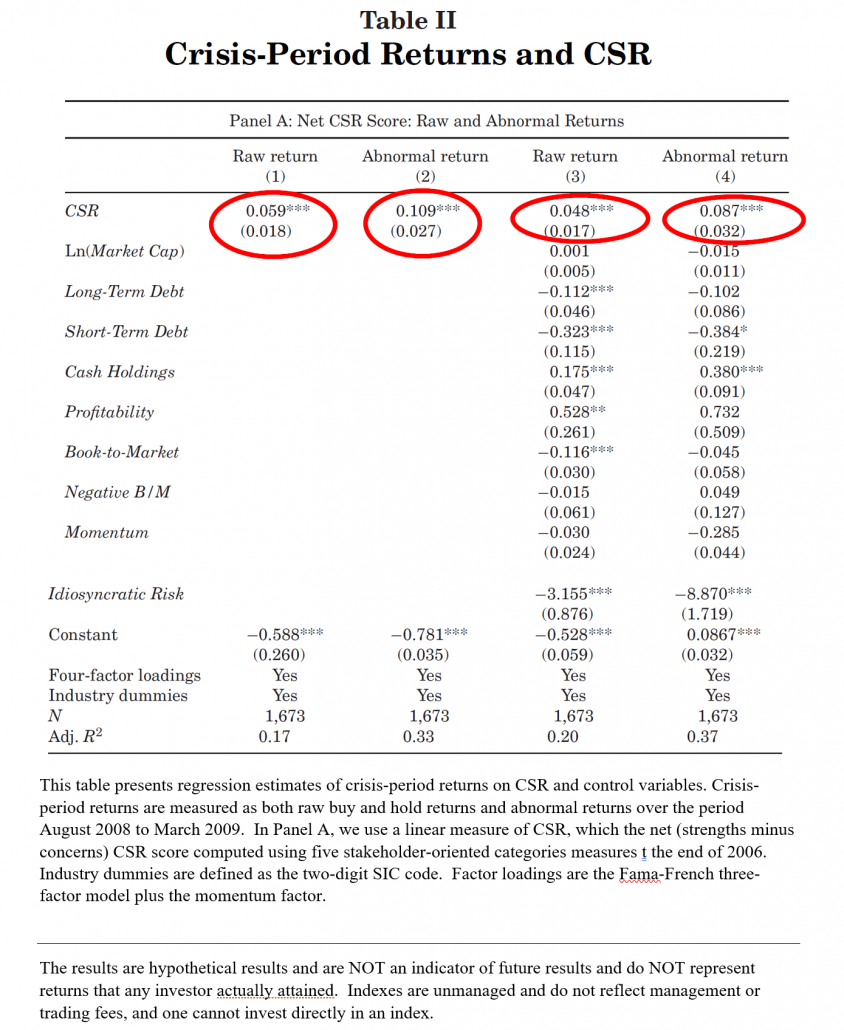

- YES. CSR practiced over time, builds up a reservoir of social capital and trust that companies can draw upon during periods of crisis. The performance difference between firms with high versus low CSR ratings was about 4% after adjusting for risk, including 2-digit SIC codes, plus loadings on the Fama-French three factors plus momentum, as control variables. The results in Table II-columns 1 and 2, show the return performance during the crisis. A 2.25% increase in raw returns and a 4.15% increase in excess returns is associated with a one standard deviation (.381) rise in the CSR rating. When other control variables were included, the returns dropped to 1.83% and 3.31%, respectively, but remained at the same significance levels of 1%.

- Risk-adjusted returns were even larger for firms with high ESG ratings and located in geographical areas where individuals and communities are considered relatively more trusting.

- Post crisis periods were not accompanied by reversals in prices. No significant differences in high versus low CSR companies were observed after the crisis.

- The authors discuss (1) that investors may be less confident of financial information during periods of crisis and seek out metrics that convey the values, integrity and trustworthiness of the company; and/or (2) that customers, employees, suppliers, community members perceive that the implied contracts are less likely of being abrogated for high CSR firms. It is through these mechanisms that the prices of companies with higher “scores” on CSR ratings, are bid up offering a type of trust premium.

- YES. Higher financial health as indicated by higher profitability, gross margins, sales growth, sales per employee measures were associated with high CSR companies. They also raised more debt financing. All of these effects were noted during the crisis period. However, post-crisis period those effects were diminished somewhat.

- CAVEATS: The authors discuss and dismiss several caveats. Although omitted variables, time-varying firm differences and endogeneity of the central variables are handled through rigorous empirical design, numerous robustness tests, and control variables. In addition, CSR ratings are held constant in the short term and are informative about impacts on valuation during the crisis, they are much less helpful in estimating impacts during normal times.

Why does it matter?

Consistent with research on social capital published in other disciplines, this study confirms that company level social capital is equally important when the trust regarding our financial institutions and markets plunge as they did in 2008-2009. The conclusions presented here argue that the trust level between a company and its investors is as equally important as its trust level with other stakeholders during crisis periods.

The insurance umbrella that high CSR ratings provide go well beyond the simple reduction in sources of “legal” unsystematic risk during normal periods. Finally, and most importantly, this research underscores the need to expand the scope of financial impacts when attempting to understand corporate performance during a crisis of trust.