Rankings and Risk-Taking in the Finance Industry

- Michael Kirchler, Florian Lindner, and Utz Weitzel

- The Journal of Finance, Fall 2018

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

What are the Research Questions?

Rankings are everywhere in the finance industry. A number of papers identify bonus schemes and tournament incentives(1)among the main drivers of excessive risk-taking in developed financial markets.

The article studies the impact of rankings on professionals’ risk-taking investment decisions.

The authors ask the following research questions:

- Do non-incentivized rankings and tournament incentives drive professionals’ risk-taking in framed investment decisions?

- Do professionals care about relative performance?

- Are there gender differences in the above behaviors?

What are the Academic Insights?

By conducting lab-in-the-field experiments(2) and online experiments with 657 decision-making financial professionals from major financial institutions in various OECD countries as well as laboratory experiments with 432 students, the authors find the following:

- YES- The authors find that underperformers take more risk when an anonymous and non-incentivized ranking is displayed compared to a baseline setting without rank revelation. The observed effect of rank incentives is remarkable given that it was used an anonymous ranking instead of public disclosure of identities. Additionally, the authors find that while monetary incentives in the tournament treatment increase risk-taking in general, they have little effect on the rank-dependent investment behavior observed in the ranking treatment: in both treatments, underperformers take more risk than outperformers.

- YES- The authors rerun the experiment with student participants. They find that their investment behavior is not driven by rankings—only payout-relevant rankings in the tournament treatment increase students’ risk-taking. This suggests that professionals care more about relative performance and gain a higher utility from rank incentives.

- NO- Results suggest that financial professionals, no matter their gender and whether they operate under a private or professional identity,show similar concerns for relative performance.This indicates that male and female professionals who self-select into the industry show similar behavior, and hence increasing the ratio of women without changing the business culture might be ineffective.

Why does it matter?

This study contributes to the growing literature on the behavior of financial professionals, which is still in its infancy. Shedding more light on the behavior of professionals is important as they play a central role in the economy. Its findings have a series of practical implications:

- Regulators should be aware that not only tournament incentives, but also the widespread use of rank incentives, could lead to excess much risk in the financial sector.

- Underperforming professionals’ increased appetite for risk implies that regulating monetary tournament incentives may be ineffective if rank incentives trigger similar behavior.

- Because competitive pressure in the finance industry ultimately originates with customers to the extent that they demand high abnormal returns, better financial literacy of customers could help prevent unrealistic demand for outperformance.

- Rank incentives can substitute for expensive bonuses, which can be advantageous if increased risk-taking is a desirable strategy. If increased risk-taking is not desired, results suggest that companies might want to downplay rank incentives, in particular to limit the risk-taking of underperformers.

The Most Important Chart:

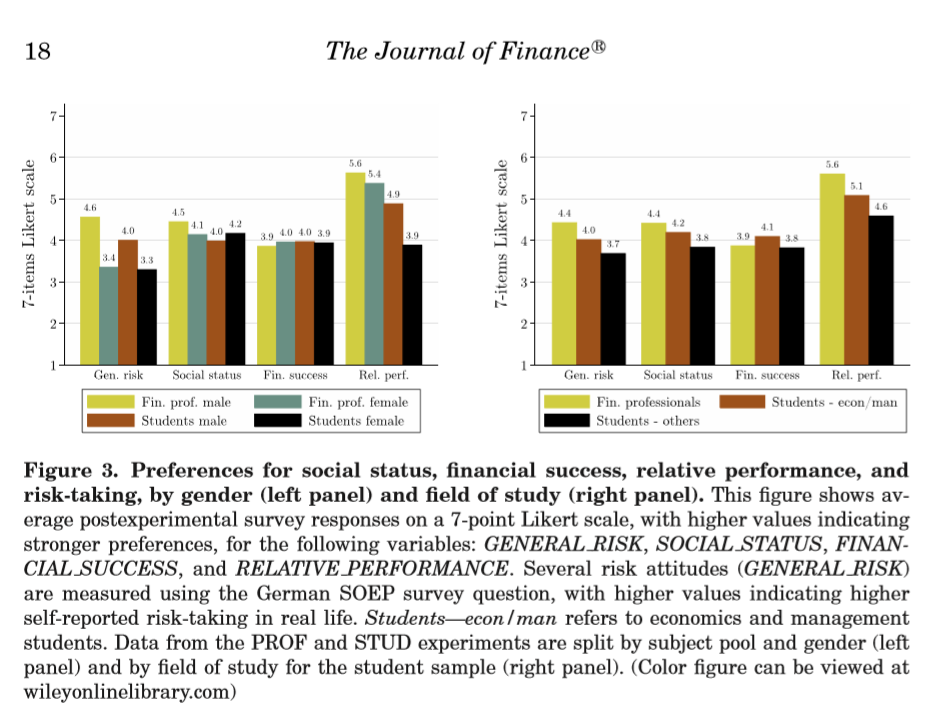

Figure 3 shows no differences between professionals and students in the average importance of financial success, but highly significant differences with regard to social status and relative performance. Social status is significantly more important for professionals than for students, and relative performance is the most important trait. These results support the view that subject-pool-specific differences in attitudes about relative performance can explain differences in rank-dependent risk-taking between professionals and students.

Abstract

Rankings are omnipresent in the finance industry, yet the literature is silent on how they impact financial professionals’ behavior. Using lab-in-the-field experiments with 657 professionals and lab experiments with 432 students, we investigate how rank incentives affect investment decisions. We find that both rank and tournament incentives increase risk-taking among underperforming professionals, while only tournament incentives affect students. This rank effect is robust to the experimental frame (investment frame versus abstract frame), to payoff consequences (own return versus family return), to social identity priming (private identity versus professional identity), and to professionals’ gender (no gender differences among professionals).

| 1. | ↑ | Tournament incentives are characterized by two main components: 1) salary and other material rewards that depend on performance; 2) nonmonetary incentives or “rank” incentives to outperform peers |

| 2. | ↑ | Each lab-in-the-field and laboratory experiment is divided into two parts. In the first part, participants played an investment game. In the second part, they participated in additional tasks designed to elicit risk attitudes, loss aversion, and personal characteristics. |

About the Author: Elisabetta Basilico, PhD, CFA

Dr. Elisabetta Basilico is a seasoned investment professional with an expertise in “turning academic insights into investment strategies.” Research is her life’s work and by combing her scientific grounding in quantitative investment management with a pragmatic approach to business challenges, she’s helped several institutional investors achieve stable returns from their global wealth portfolios. Her expertise spans from asset allocation to active quantitative investment strategies. Holder of the Charter Financial Analyst since 2007 and a PhD from the University of St. Gallen in Switzerland, she has experience in teaching and research at various international universities and co-author of articles published in peer-reviewed journals. She and co-author Tommi Johnsen are currently writing a book on research-backed investment ideas. You can find additional information at Academic Insights on Investing.