Using portfolio theory, the authors of this piece develop an approach for estimating the degree of political risk between a country and its export destination and the status of political relationships. The research about political beta presented is the first to apply portfolio theory to problems associated with global politics.

Political Beta

- Raymond Fisman, April Knill, Sergey Mityakov, and Margarita Portnykh

- Review of Finance

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

What are the research questions?

The marriage of investment theory and global politics produces two predictions confirmed by the analysis: 1. Exports and the temperature of political relationships and exports are positively correlated; 2. Exports are less sensitive to changes in the temperature of political relationships of countries characterized by low or negative correlations with other export markets.

What are the Academic Insights?

Here are the main findings:

- International trade and the state of political relationships has a large impact on international trade. As political relationships between Russia and it’s trading counterparts deteriorate, exports also decline. The authors estimate that a one standard deviation deterioration in political relationships produces a 10% reduction in exports.

- The responsiveness of firms’ export behavior to changing political status is a function of the market of countries and their contribution to the total political risk profile of the firm. From the authors, “we calculate a “firm-country” pair “political b,” which captures the extent to which a destination country’s political relationship with Russia tends to comove with Russian relations with other destination countries to which a given firm exports.” The degree to which a specific export market adds to the firm’s systematic or non-diversifiable risk is captured by the coefficient of a regression model of political relationships with a specific export country against all export markets for that firm. This is consistent with the traditional CAPM as developed by Sharpe (1964) and Lintner (1965).

- Diversifying unsystematic risk in the context of portfolio construction has a parallel interpretation in this research. The authors report that changes in political status with a given export market leads to small changes when low political “beta” are considered. The volatility of Russia’s political relations with a specific country is unimportant compared to that country’s systematic risk or “political beta”.

- If the firm-level data is aggregated, the results cannot be duplicated. The nature of the political risk of a given export market cannot be derived from country-level data.

Why does it matter?

This article should be of interest for those managers interested in the interaction between political behavior and international trade between and among US and non-US markets. The friction to international trade introduced by the political temperature among and between countries described in this research is just the tip of the iceberg. A novel application of traditional portfolio theory developed and tested in the context of global political relationships is described in detail in this article. While the financial theory used is somewhat dated in that “beta” has become unremarkable in its ability to measure systematic risk. I would be interested in seeing the application of a multifactor approach to this topic.

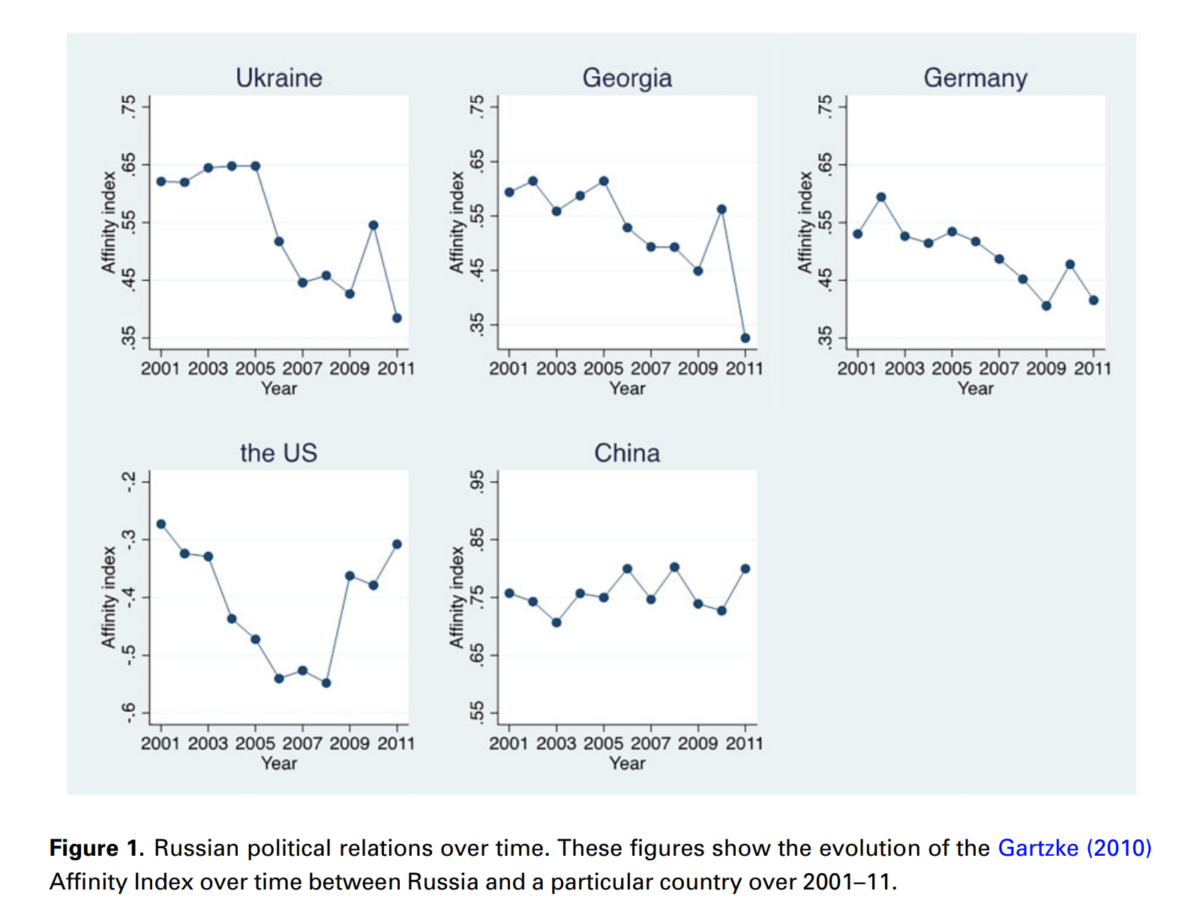

CAVEAT: The dataset is limited to Russian firms and exports to various destination markets; therefore, generalizations made to other countries should be considered. Firm-level data was acquired from SPARK-Interfax: spark-interfax.com; export-level data was acquired from www.russbd.com. Please refer to those third parties for data availability requests. The datasets are proprietary but extensive and include “firm-by-destination-country data from Russia for all exporting companies during 2001–11, combined with a measure of bilateral political relations based on United Nations voting records (Gartzke, 2010)”. The Affinity Index found in Gartzke (2010) is presented for select countries in Figure 1 below. The variability in the political relationship between Russia and the Ukraine, Georgia, Germany, China and the US is present and substantial.

The most important chart from the paper

Abstract

Using a portfolio theory framework, we introduce the concept of “political beta” to model firm-level export diversification in response to global political risk. Our model predicts that firms are less responsive to changes in political relations with lower beta countries—those that contribute less to the firm’s total political risk. We document patterns consistent with our model using disaggregated Russian firm-by destination-country data during 2001–2011: Trade is positively correlated with political relations, though the effect is far weaker for trading partners whose political relations with Russia are relatively uncorrelated with those of other partners in a firm’s export portfolio.