Investing in US 10-year Yields with News Sentiment

- Nina Gotthelf and Matthias W. Uhl

- Journal of Investing, Winter 2018

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Academic literature has documented a news sentiment effect on equities ( here and here ). The authors investigate the following research question:

- Does the sentiment derived from media content impact bond market investors?

What are the Academic Insights?

By studying the sentiment extracted from articles from the entire Thomson Reuters news universe (over 400,000 news sentiment items per month from January 2003 to February 2014, totaling 130 observation months) and by applying two techniques to score sentiment (the ‘bag-of-words’ approach and a dynamic learning algorithm), the authors find the following:

- YES- forecasts based on the model containing news sentiment are significant for predicting 10-year US Treasury yields. As a result, profitable trading strategies can be derived to deliver potential outperformance over the benchmark.

Why does it matter?

This paper adds to the literature that alternative data sets like news sentiment can be additive to traditional macroeconomic variables based model, even in the fixed income asset class.

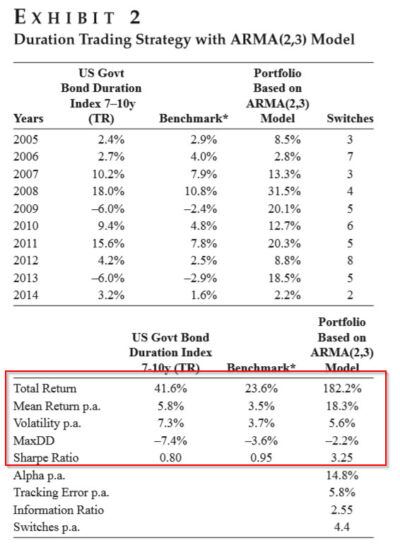

The Most Important Chart from the Paper

Exhibit 2 shows the performance of the trading strategy based on the one-step-ahead out-of-sample forecasts from the ARMA(2,3) model with news sentiment, ISM manufacturing, consumer price index, and non-farm payrolls. The duration index refers to the USD duration 7–10 years index, and the cash index refers to the JP Morgan 3-month USD cash index. The benchmark consists of 50% USD duration 7–10 years index and 50% JP Morgan 3-month USD cash index. The performance of the portfolio is based on a strategy that invests 100% in the USD duration 7–10 years index if the signal is above 0% and 100% in the JP Morgan 3-month cash index if the signal is below 0%. (1)

Abstract

The tonality of news reporting has been shown to have explanatory and predictive power for equity prices. Using a novel approach and data set, we demonstrate that the news sentiment effect also holds for US government bond duration. We construct a successful trading strategy for the US 10-year government bond yield based on news sentiment.

References

| 1. | ↑ | Benchmark consists of 50% Barclays AA+ US Government 7–10y duration bond total return index and 50% USD 3-month cash index. |