Lowering Portfolio Risk with Corporate Social Responsibility

- Clark, Krieger, and Mauck

- Journal of Investing, February 2019

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

In this paper, the authors propose a different research approach to study Socially Responsible Investing (SRI). We’ve touched on SRI in previous posts here and here. This paper takes SRI in a different direction and rather than focusing on whether SRI adds or detracts to the performance of a portfolio, they study the relationship between corporate social responsibility (CSR) scores and future extreme returns.

What are the Academic Insights?

The authors use data from Kynder, Lydenberg and Domini Research (KLD) from 2003 to 2016 and calculate firm CSR scores based on an adjusted measure from Deng et al. (2013).

Specifically, they include seven dimensions:

- Community

- Corporate governance

- Diversity

- Employee relations

- Environment

- Human rights

- Product quality & safety.

Additionally, they follow the Fodor et al. (2013) approach in their analysis of extreme returns. They find:

- The adjusted CSR measure is statistically ( 1% level) negatively related to the extreme return indicator. This result is consistent with findings from Kim et al. (2014) that CSR is related to the risk of a stock price crash.

- CSR is an important predictor of the likelihood of firms experiencing extreme returns.

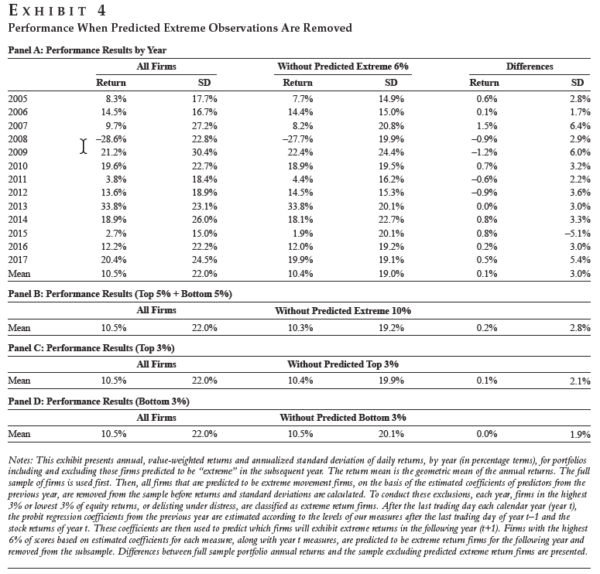

- A portfolio of stocks that excludes those predicted to experience extreme returns realized similar average returns ( 10.4%) compared to a value-weighted market portfolio (10.5%) with a much lower standard deviation ( 3% lower).

Why Does it Matter?

Traditional SRI has involved avoiding socially irresponsible firms and/or tilting investment choices toward the most socially responsible firms. The authors of this paper make an argument for a different use case of SRI, and instead, make use of the established negative relationship between CSR and volatility by creating a model to predict extreme return firms.

The Most Important Chart from the Paper

Abstract

This article examines the link between corporate social responsibility (CSR), as measured by the Kinder, Lydenberg, and Domini Research and Analytics Inc. (KLD) data, and the likelihood that a firm experiences an extreme return in a given year. An extreme-return firm is defined as one that has a return either in the top or bottom 3% of all firms with CSR data. The authors find CSR is negatively related to the likelihood of a firm experiencing an extreme return. Accounting for this negative relationship significantly improves a model used to predict future extreme returns. Finally, they form two portfolios: one with all firms with CSR data and one with all firms with CSR data except those firms with the highest predicted probability of extreme returns in the following year. Our results indicate that the returns for the two portfolios are nearly identical. However, the standard deviation of the portfolio excluding likely extreme movers is 3% lower than the portfolio with all firms. Thus, this simple portfolio strategy incorporating CSR has the potential to lower risk without impacting return.