Does the Fed Impact Stock Prices?

- McDonald, Puleo and Shadmani

- Journal of Investing, February 2019

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Since the global financial crisis, the financial press has periodically asserted that the Federal Reserve’s actions were the driving force behind rising stock prices. This study investigates this assertion by asking the following research question:

- Is there a relationship between stock prices and the level of central bank influence in interest rates (where influence= difference between the interest rate set by the Fed and other central banks and the interest rate that the Taylor rule calculates)?

What are the Academic Insights?

The authors use data from a series of countries: US, Canada, UK, Germany and Australia over a time frame from 1971- 2014 ( some countries have a more recent inception date depending on data availability). The Central bank influence is proxied by the “Taylor Rule residuals”.

They find the following:

- The Taylor Rule residuals have a correlation with the SP500 returns of negative 0.05, suggesting muted evidence that greater levels of unorthodox Fed policies are associated with lower stock returns. This result is not statistically significant and most importantly, it is an opposite finding to the common financial media stories.

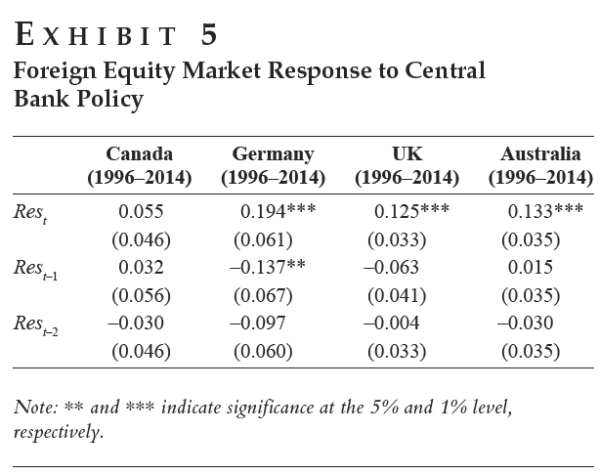

- Results are different outside of the US. The authors find that internationally there is a strong positive relationship with the taylor rule residuals and stock market returns, suggesting that central bank influence does bolster stock returns.

Why does it matter?

This paper demonstrates that Fed actions to reduce interest rates below equilibrium Taylor Rule levels are correlated with lower equity market returns. This effect occurs with a lag rather than contemporaneously. Outside the US, Central Bank policy has a positive impact on equity prices in the current quarter, which is followed by a modest and statistically insignificant reversal. It remains unclear what drives that difference in outcomes internationally. This can be an interesting topic to be investigated in future research!

The Most Important Chart from the Paper:

Abstract

The influence of the Fed’s actions on equity prices has been a source of significant speculation in recent years. This article uses a well-regarded measure for the “fair” value of interest rates to measure the degree to which the Fed is influencing interest rate and then relates that level of interference to equity returns. We find that Fed’s actions are correlated with a modest negative impact on US equity prices—that is Fed interference has a slight negative relationship with broader equity returns. In contrast, outside the US, Central Bank interference generally has a stronger positive relationship to equity returns.