The Impact of Crowding in Alternative Risk Premia Investing

- Nick Baltas

- Financial Analysts Journal

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

The focus of this study is on the response of typical or systematic risk premia to crowding (large inflows of capital). In particular, the paper focused on documenting the response of commonly recognized systematic risk premia strategies to periods, following the identification of crowded conditions. What the focus is not: the impact of a broad-based unwinding such as the quant meltdown of 2007, nor market impact, nor strategy capacity issues. The main hypothesis is based on classifying factor strategies into one of two categories: convergent (such as value) vs. divergent (such as momentum). The measure of crowding (hereafter labeled the Co-metric indicator) and methodology follows Lou and Polk (2014).

- Is there evidence for the divergence hypothesis in systematic factors?

- Divergent factor risk premia are those lacking a “fundamental anchor”, as an example, buying well-performing stocks and selling poorly performing stocks. A divergent strategy is self-reinforcing in itself and lacks a fundamental rationale. Investor inflows to a divergent factor are likely to be destabilizing as inflows can drive prices away from fundamentals, increasing the probability of an adverse correction.

- Is there evidence for the convergence hypothesis in systematic factors?

- Convergent risk premia do have a fundamental anchor and are inherently self-correcting processes. For example, underpriced value stocks become less undervalued/fairly priced as they are purchased or overbought. Investor inflows to a convergent factor are therefore likely to have a stabilizing effect as prices converge to a level consistent with fundamentals.

What are the Academic Insights?

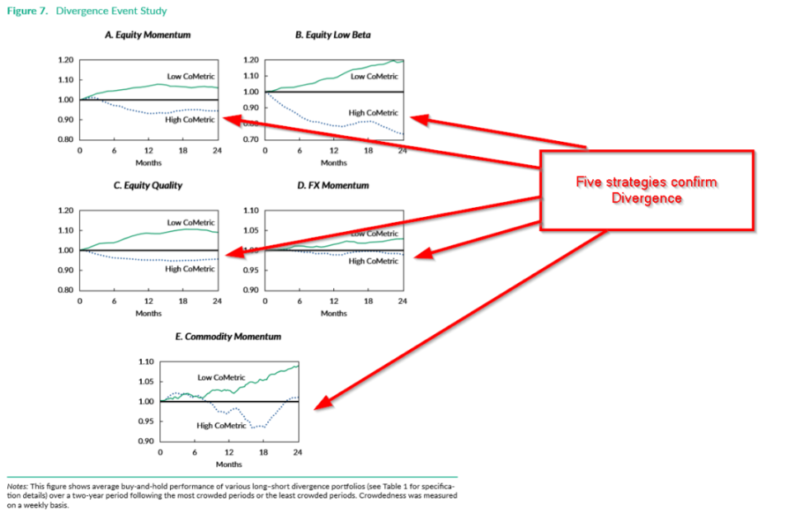

- YES. Using an event study format, all divergence strategies underperformed (outperformed) following high (low) Co-M periods for the 6-month and 1-year horizons, but not the 1-month period, as shown in the chart below. The t-stats for the high and low spreads, maxed at the 1-year mark for most strategies: -8.41 for equity low beta, −5.14 for equity quality, −3.07 for currency momentum, and −2.92 for commodity momentum. In general, low levels of crowdedness result in outperformance, and when these strategies become very crowded they underperform.

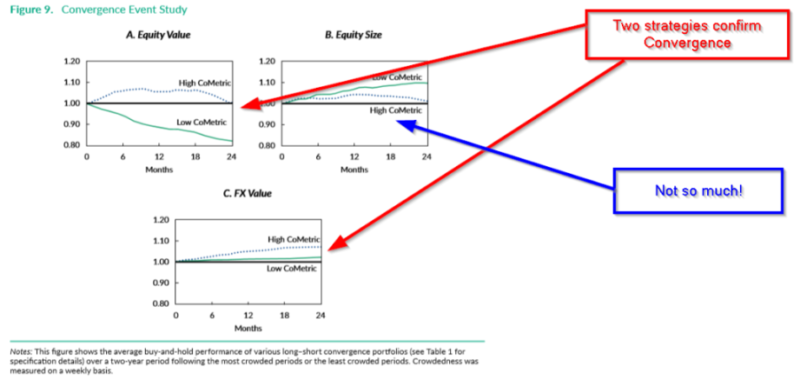

- YES. High (low) levels of crowding appear to be antecedent conditions to future outperformance (underperformance), consistent with expectations of the convergent hypothesis. The performance is maxed at the 1 year period, with significant t stats of 5.86 for FX value and 11.78 for equity value. The equity size strategy failed to meet expectations in terms of statistical significance but did turn in a positive spread of 2.19% at the 6 mo horizon, under high Co-M and 4.76% for low Co-M. Those returns remained positive at the 1-year horizon, although the spread was not significant.

Why does it matter?

This article is an effective and insightful explanation of the author’s take on factor crowding and how it may interact with the performance of factor premia strategies. The obvious application would be to practitioners of factor timing, not to mention the contribution made to the ongoing and everlasting debate on the viability of timing itself. For practitioners of long-only factor strategies, the predictability of Co-M offers an opportunity not only for revising expected returns but for assessing the threat to a strategy given the existence of significant flows into and out of the factor.

The most important charts from the paper

Abstract

Crowding is a major concern for investors in the alternative risk premia space. By focusing on the distinct mechanics of various systematic strategies, this study introduces a framework that provides insights into the implications of crowding for subsequent strategy performance. Understanding such implications is key for strategy design, portfolio construction, and performance assessment. The analysis shows that divergence premia, such as momentum, are more likely to underperform following crowded periods. Conversely, convergence premia, such as value, show signs of outperformance as they transition into phases of larger investor flows.