Conflict of Interest in Mutual Fund Sales: What Does the Data Tell Us?

- Jasmin Sethi, Jake Spiegel, and Aron Szapiro

- Journal of Retirement, Winter 2019

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Conflicts of interest can arise when financial advisers and/or broker/dealers are given incentives or receive revenue sharing from certain fund sponsors to promote their products for reason other than the financial need of the client. It could also be that the selling broker receives a load, or a fee, associated with attracting an investor into a fund. The Department of Labor (DOL) introduced the fiduciary rule based on economic analysis showing harm to investors from loaded funds. In fact, based on estimates from Christofferson, Evans, and Musto (CEM 2013), investors potentially lose, in aggregate, between $ 8.6 billion to $17 billion a year.

The authors continue the work from CEM and investigate:

- How does the practice of “load’s sharing 1” affect flows and returns?

What are the Academic Insights?

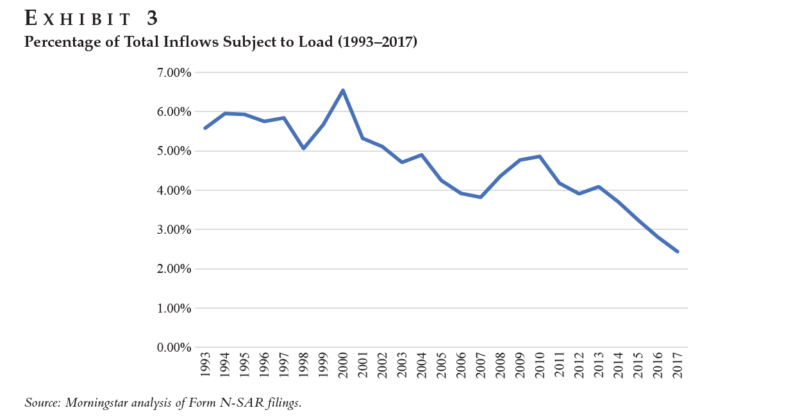

The authors study the period from 1993 to 2017.

- Like Christofferson, Evans, and Musto 2013, the authors find that load sharing drives flows to funds through unaffiliated brokers more so than captive brokers during the period studied.

- They don’t find that these results are driven by any particular sub-period of the overall sample. In fact, the effect of excess loads on inflows is consistently positive over time.

- They find evidence suggesting that the DOL fiduciary proposal did indeed have an impact on flows driven by excess loads to funds through the unaffiliated broker channel: funds that paid excess loads to unaffiliated brokers previously saw higher inflows, but the proposal of the fiduciary rule appears to have reversed that effect.

- They find that excess loads have a negative relationship with excess returns throughout this period studied. However, controlling for lagged returns turned the negative relationship as statistically insignificant. This was true for both periods (pre and post-DOL). The author interprets the lack of statistical significance likely derives from the fact that Dodd-Frank Section 913, which empowered the SEC to promulgate a new standard of conduct for broker/dealers, and the proposal of the DOL fiduciary rule had already influenced the culture around performance accountability. Brokers likely had already been given incentives to direct clients toward higher-quality—or at least higher-performing— funds because of the increased scrutiny of their choices.

- Overall, they find that harm from a key financial conflict of interest—load sharing between mutual funds and intermediaries—appears to have declined since 2010, the last year on which much of the Department of Labor’s regulatory impact analysis for its fiduciary rule was based.

Why does it matter?

Flows into mutual funds paying unusually high excess loads declined after the DOL proposed its fiduciary rule in 2015, and this shift was statistically significant. Good news for investors!

The Most Important Chart from the Paper:

Abstract

Conflicts of interest can arise when financial advisors and brokers have a financial incentive to recommend certain products to investors. Identifying the effects and quantifying the costs of conflicted advice is a challenge for researchers and regulators alike. In this article, the authors build on the methodology developed by Susan Christofferson, Richard Evans, and David Musto and employed by the US Department of Labor (DOL) in its regulatory impact analysis of the fiduciary rule, a package of rules finalized in 2016 that has since been vacated in a court challenge. The authors examine data from public filings and Morningstar to quantify how payments to brokers drive fund flows and affect investor returns and to determine the extent to which regulation has been effective in mitigating conflicts of interest.