Mutual fund investments in private firms

- Sungjoung Kwon, Michelle Lowry, Yiming Qian

- Journal of Financial Economics

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

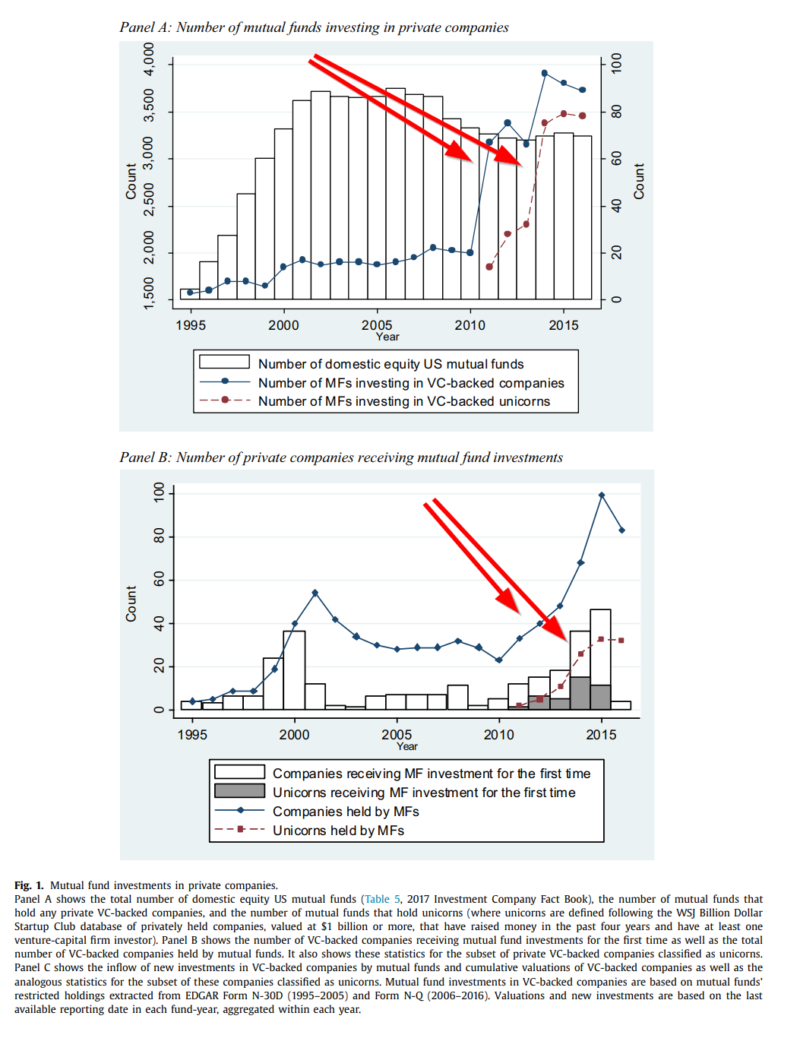

Although one of the largest investors in public companies, mutual funds have increased investments in private firms at least since the mid 1990s. Market valuation of those investments increased from $16 million in 1995 to over $8 billion in 2015. The authors of this study focus on three factors that have potentially contributed to this trend and provide insight into the following questions:

- Do private firms seek out alternative sources of capital to avoid or postpone public listing?

- Do mutual funds seek out private companies as investments in order to obtain higher returns, to increase diversification and/or to participate in IPO offerings?

- Are mutual funds sources of “dumb money”, that is, willing to invest at high valuations?

What are the Academic Insights?

- YES. From the perspective of private companies: The hypothesis, in this case, is that the ability to stay private for longer periods of time allows private companies to develop larger economies of scale and postpone costs of public listing associated with regulatory requirements. The authors present substantial evidence in support of the “delay” motivation. Mutual funds provided 38%(average)/32%(median) of financing beyond that supplied by VCs, between 2011-2016 in this analysis. The attraction for mutual funds as a source of capital to private companies resides mainly with their reluctance to demand strong control rights and a desire to exit at targeted dates.

- YES. From the perspective of mutual funds: The attraction of private companies to mutual funds is associated with gaining competitive advantages by expanding the universe of investible opportunities. As the number of public companies has declined, portfolios offered by mutual funds are less differentiated from competitors. Allocations to the private market also ensure larger share allocations when those firms IPO. The fierce competition from passive vehicles and ETFs offering lower fees further exacerbate the pressures mutual funds face. Mutual funds with private investments prior to an IPO had a higher chance of receiving an allocation 64% vs those without an allocation at 21%. Mutual funds exhibited an average return of 4.8% monthly for private investments that exited with an IPO. The authors construct an equally-weighted benchmark as a comparison and conclude mutual funds earned 1.7x to 2.6x from private investments. The correlation between the constructed index and private investments was -.04, suggestive of diversification benefits accruing to mutual funds. There was no evidence found to indicate that other sources of capital such as PE and corporate VC were less available to fill the void.

- NO. From the perspective of the VC: In their discussion, the authors make an interesting statement: “VCs possibly look to mutual funds as a source of dumb money willing to invest at high valuations”. Hmmm. OK, we’re game. They argue for the key role that VCs play on company boards and in capital-raising. VCs would come down on the side of mutual funds as a favored source of capital if they were willing to accept higher valuations or lower ownership percentages than alternative sources. There was little support found for this hypothesis. Why would all investors included in the same round of fundraising, where all receive the same terms, be willing to invest alongside dumb money? They don’t. There was little to no evidence that fundraising rounds that included mutual funds were overpriced. Risk adjustments using the market and 3 Fama-French factors failed to indicate mutual funds received lower alphas.

Why does it matter?

The research and discussion presented in this article relates to the current debate on the costs and benefits of becoming a public firm. Apparently, the costs of going public seem to outweigh the benefits at an increasingly larger margin. The benefits of capital and liquidity normally associated with being a public company, now accrue to private companies in predictable ways. Further, this research provides evidence that the IPO market is also changing in a systematic fashion. Thanks to regulatory changes that resulted in a larger supply of capital available to private firms, the number of IPOs in the US has declined. How these developments will affect the role of regulation with respect to protecting individual investors is becoming more critical.

The most important chart from the paper

Abstract

Historically, a key advantage of being a public firm was broader access to capital, from a disperse group of shareholders. In recent years, such capital has increasingly become available to private firms as well. We document a dramatic increase over the past twenty years in the number of mutual funds participating in private markets and in the dollar value of these private firm investments. We evaluate several factors that potentially contribute to this trend: firms seeking extra capital to postpone public listing, mutual funds seeking higher risk-adjusted returns and initial public offering (IPO) allocations, and venture capitalists (VCs) seeking new investors to substantiate higher valuations. Results indicate that the first two factors play a significant role.