The Firm Next Door: Using Satellite Images to Study Local Information Advantage

- Kang, Stice-Lawrence, Wong

- Journal of Accounting Research, 2021

- A version of this paper can be found here.

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Prior academic research has shown 1 that “local” investors (i.e., investors are physically located near the company) may benefit from an information advantage. Researchers in this paper study use satellite imagery, which was not commercially available during the study sample, to identify the source of “local” investor edge.

The researchers ask the following question:

- Do institutional investors have an information advantage relating to local operations?

What are the Academic Insights?

By using satellite image data on the number of cars in nearby store parking lots as a measure of store-level performance (92,668 stores of 71 publicly listed U.S. retailers during the years 2009 to 2015 2), the authors find that:

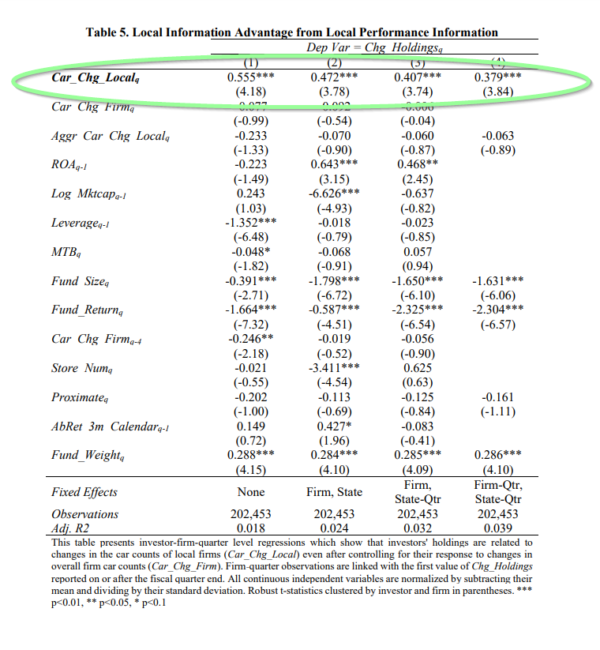

- Investors adjust their stock holdings in line with the car counts of local stores, but not with the concurrent performance of the overall firm. On average, a one standard deviation increase in local car counts is related to investors increasing their holdings by 9% to 14%.

- Trades that incorporate local car count information yield annualized abnormal returns of roughly 2%. These abnormal returns are comparable in economic magnitude to those documented in the previous literature 3 and suggest that information about local operations is one source of local information advantage.

- The response to local information is greater in regions with stronger social ties.

- Institutional investors who are industry specialists are more responsive to local information.

- Institutional investors who charge their clients performance fees respond more to local information, consistent with them having greater incentives to use local information when they stand to benefit personally.

- The response to local information is largest for non-indexer institutional investors, whose active investment strategies are more reliant on timely information signals.

- After the satellite data used in this study became commercially available, institutional investors who had access to the data began incorporating the car count information of all stores into their trades, with no incremental response to the performance of local stores. These results suggest that access to big data enables investors to overcome their non-local information disadvantage, providing additional evidence on the benefits of big data.

Why does it matter?

This paper adds to the emerging field which utilizes big data to examine economic questions. It is particularly timely as investors now routinely supplement the formal financial statements with less traditional information sources such as satellite imagery. At the same time, there are some caveats to keep in mind: the results of the study may have limited generalizability because it examines only institutional investors of retail firms, and examines only the local information that is correlated with car counts. Also, the study cannot observe investors’ information sets and must infer their information by observing their trades

The Most Important Chart from the Paper:

Abstract

We use novel satellite data that track the number of cars in the parking lots of 92,668 stores for 71 publicly listed U.S. retailers to study the local information advantage of institutional investors. We establish car counts as a timely measure of store-level performance and find that institutional investors adjust their holdings in response to the performance of local stores, and that these trades are profitable on average. These results suggest that local investors have an advantage when processing information about nearby operations. However, some institutional investors do not adjust for the quality of their local information and continue to rely on local signals even when they are poor predictors of firm performance and returns. This overreliance on poor local information is reduced for institutional investors with greater industry expertise and those with greater incentives to maximize short-term trading profits.

Notes:

- (Coval and Moskowitz, 2001; Bernile et al., 2015 ↩

- the analysis is performed on the sample before the dataset became commercially available ↩

- Coval and Moskowitz [2001], Baik et al. [2010] ↩