Are Passive Funds Really Superior Investments? An

Investor Perspective

- Edwin J. Elton, Martin J. Gruber & Andre de Souza

- Financial Analysts Journal

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

The research (and the theory) has convincingly shown that mutual funds should and do underperform a passive index by an amount approximately equal to fees. However, no one has actually tried to construct the active mutual fund dominating passive strategy using commercially available products. It seems like such an obvious test. This study is designed to answer that question on a practical basis. Can investors really assemble a portfolio of ETFs that outperform an actively managed mutual fund on a risk-adjusted basis? Turns out the answer is yes, and it’s a relatively simple approach.

The study used a sample consisting of 883 actively managed equity funds listed by Morningstar as of January 2003. This insured a 15 year return history on each active fund. The authors used screens to eliminate incubator and small firm biases, and required each fund to hold 90% equity. Also included were all ETFs listed by Morningstar in January of 2003 that were candidates for matching the active funds.

- Can investors construct an investable strategy by identifying a set of ETFs (passive funds) that will outperform a specific active fund while matching its risk?

What are the Academic Insights?

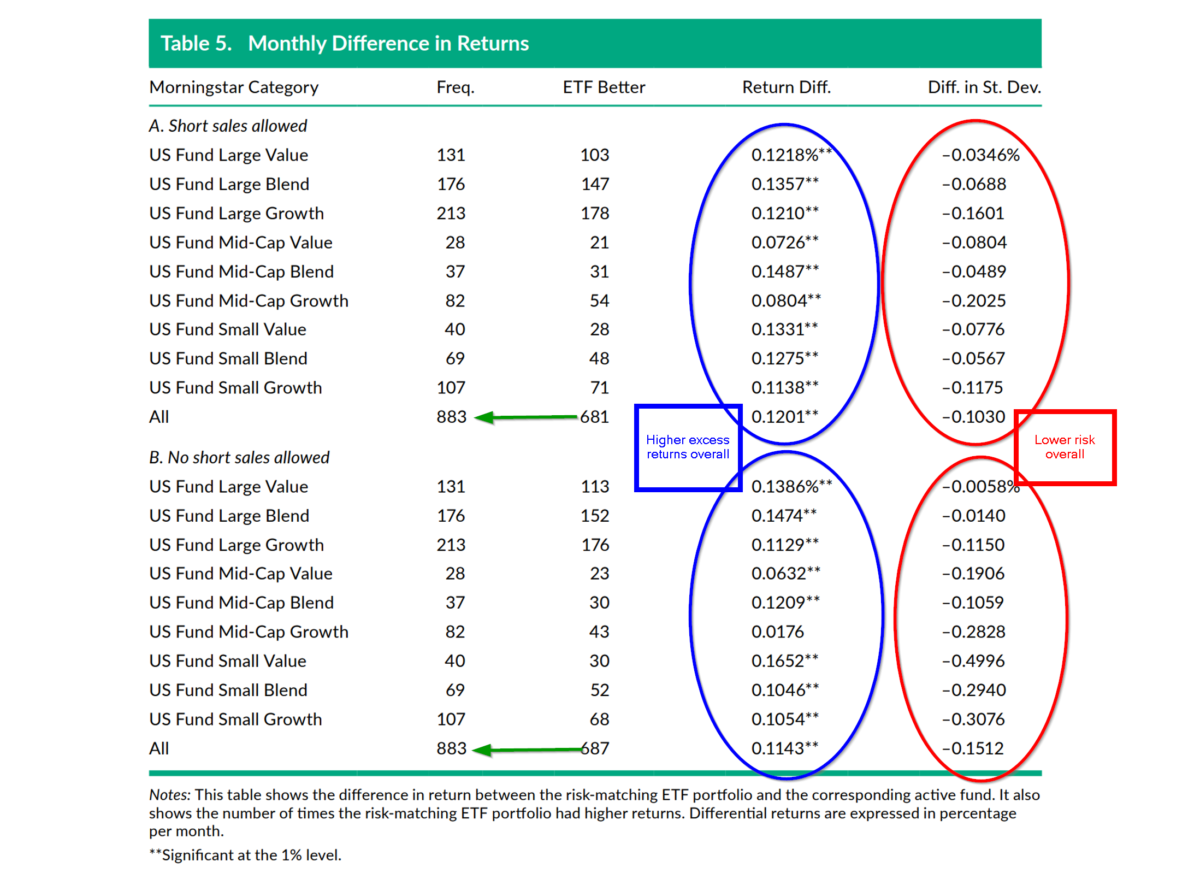

- YES. The authors constructed a set of 5 ETFs selected on the basis of the lowest cost and a specified benchmark. Eleven groupings of benchmarks were initially identified via cluster analysis. Indexes were included if used by any ETF as a benchmark. For each of the 11 groups, a representative or matching index was chosen, then reduced to four (plus a market index) after cross-correlations were taken into account. The lowest cost ETF following each of the final five was used as the passive substitute portfolio. As shown in Exhibit 5 below, between 77% (short sales allowed) and 78% (no short sales) of the matching portfolios outperformed the active fund, while turning in an annual excess return of 1.37%. That percentage increased to 90% if active funds with loads were included in the sample. The matching portfolios also exhibited lower standard deviations across the board. All results, with the exception of the midcap growth group, were statistically significant at 1%. Along with the midcap growth, the midcap value showed the smallest return difference between the matching and active fund. The authors also tested 3 variations in the 5 ETF model by adding 3 ETFs to the mix, individually: Momentum ETF, Russell Midcap Growth ETF, and Russell 2000 Value ETF. The 3 were chosen based on previous research suggesting they may outperform an active fund. Results either deteriorated or improved only slightly. In any case, none of the 3 had a significant impact on the results.

- A second, much simpler, approach was attempted to determine how an investor could easily (that is, without complex computations) select a set of outperforming ETFs. The lowest cost ETF matching the benchmark obtained from the fund prospectus of the active fund was determined and used. The results were still very attractive although not quite as strong. With no short sales allowed, the identified benchmark produced a return lower than the matching ETF 72% of the time, with an annual alpha of 1.01%.

Why does it matter?

A major drawback associated with recommending passive strategies over active funds is the issue of identifying investable products that are passive in nature. Much of the research regarding mutual fund performance, for example, uses benchmarks that are not really investable. An investor attempting to implement a passive Fama-French, Carhart, or Q factor model in lieu of an active fund has little to nothing to choose from in the retail market. In the absence of such an approach, it does appear at least from this study, that investors are able to outperform actively managed mutual funds by investing in the lowest cost ETF that matches the active fund’s benchmark. That’s a relief!

The most important chart from the paper

Abstract

A number of papers have demonstrated that over historical periods, a specified set of factors has outperformed actively managed funds. In almost all cases, however, the factors used or the procedures followed are not replicable by tradable passive investments. In addition, tradable passive investments have expense ratios that almost always cause them to underperform indexes. The purposes of this article are to identify a small set of exchange-traded funds that captures most of the variation in the population of potential indexes and to determine whether a combination of exchange-traded funds from this small set can be identified that outperforms active mutual funds in future periods.