Factors and Risk Premia in Individual International Stock Returns

- Geert Bekaert, Eric Engstrom and Andrey Ermolov

- Journal of Financial Economics, 2021

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

“Few topics in finance, arguably none, are more important than factor identification, because factors are the main principal determinants of investment performance and risk.” (Pukthuanthong et al., 2019).

(Pukthuanthong et al., 2019).

International markets have been a fertile testbed for factor research because they offer an opportunity to test old ideas on new data. Much of the previous work studying factor structure and risk premia in international markets uses highly aggregated test assets, such as country portfolios, industry portfolios, or style portfolios. In this paper, the authors propose a methodology customized for large unbalanced panels of individual stock returns to identify the key risk factors in international equity markets and estimate their risk premia.

The authors ask the following research questions:

1. Which factors are required to explain the comovements between individual stock returns?

2. Are there positive risk premia associated with the factors?

3. Do pricing errors contribute to the total expected return of equal-weighted portfolios in each region?

What are the Academic Insights?

By studying a large unbalanced panel of 64,392 stocks from 47 countries over the period 1985 to 2018, the authors build a set of factors for each of the countries and then construct regional and world factors by aggregating country factors. They consider three regions of Developed Markets (DM) (North America, Developed Europe, and Asia Pacific) and three regions of Emerging Markets (EM) (Latin America, Emerging Europe, Middle East, and Africa, and Emerging Asia).

The authors find the following:

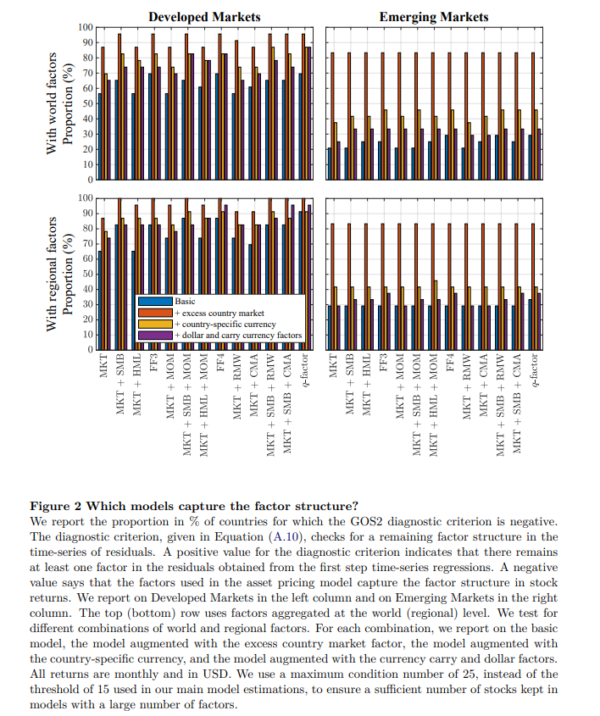

1. The excess country market factor is required in addition to the world or regional market and non-market factors to capture the factor structure in stock returns for both DMs and EMs.

2. YES- In contrast to Jegadeesh et al. (2019), the authors find that the risk premia of excess country market factors are significant in 43% to 84% of countries depending on the model and region. Unsurprisingly, their magnitude is larger in EMs than in DMs.

3. YES- The time-series median absolute pricing error, standardized by the total expected return, range from 23% to 63% across models and regions and exhibit large time-variations.

Why does it matter?

This is the first paper that documents time-varying risk premia and pricing errors from multi-factor models estimated from such a large panel of individual international stock returns. It contributes to the debate on the relative importance of global, regional, or country factors in international finance. It finds that we only need the excess country

market factor, not non-market local factors, to capture the factor structure in individual stock returns. As far as the implications for portfolio managers, the research suggests that country allocations are an important consideration.

The Most Important Chart from the Paper:

Abstract

We extract aggregate supply and aggregate demand shocks for the US economy from macroeconomic data on inflation, real GDP growth, core inflation and the unemployment gap. We first use unconditional non-Gaussian features in the data to achieve identification of these structural shocks while imposing minimal economic assumptions. We find that recessions in the 1970s and 1980s are better characterized as driven by supply shocks while later recessions were driven primarily by demand shocks. The Great Recession exhibited large negative shocks to both demand and supply. We then use conditional (time-varying) non-Gaussian features of the structural shocks to estimate “macro risk factors” for supply and demand shocks that drive “bad” (negatively skewed) and “good” (positively skewed) variation for supply and demand shocks. The Great Moderation, a general decline in the volatility of many macroeconomic time series since the 1980s, is mostly accounted for by a reduction in the good demand variance risk factor. In contrast, the risk factors driving bad variance for both supply and demand shocks, which account for most recessions, show no secular decline. Finally, we find that macro risks significantly contribute to the variation in yields, bond risk premiums and the term premium. While overall bond risk premiums are counter-cyclical, an increase in bad demand variance is associated with lower risk premiums on bonds.