Impact Investing: Killing Two Birds with One Stone?

- Caseau and Grolleau

- Financial Analyst Journal, 2020

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

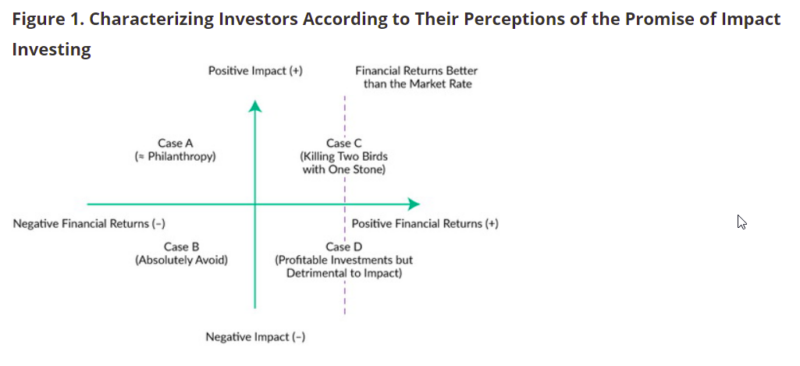

In a prior post, we covered the question “What is Impact Investing?“, which can be summarized as the attempt of making money while also doing good. There is abundant literature exploring and debating the performance of impact investing, the paper under review in this article aims to discuss why perceptions frequently differ from the reality: “when a single action (e.g., investment) is assumed to achieve multiple goals (making money and doing good), this action is frequently perceived as less effective than a single-purpose effort.” In other words, investors on both sides (finance and impact) are likely to be skeptical and to discount the objective results delivered along the two dimensions.

What are the Academic Insights?

The authors explore the following bias:

1. The goal dilution bias (Zhang et al, 2007; Grolleau, et al., 2019): “when a firm pursues financial, environmental, and social goals by a single means (the investment), people may perceive the firm as less effective at achieving the goals compared to firm pursuing each goal individually”

2. The zero-sum heuristic (Chernev 2007; Chernev and Carpenter 2001): “the tendency of individuals, including investors, to conclude that resources invested in one dimension (e.g., an environmental or social impact) are automatically matched with an equivalent loss of resources for other dimensions (e.g., the financial return)”

3. The Presenter Paradox (Weaver et al., 2012): “the conflict between adapters and agents who believe that presenting additional features will strengthen the likelihood of the agents’ success.” However, recent findings (Weaver et al.,2016) show that an audience of potential impact investors with a financial mindset is, in fact, less likely to be persuaded to engage in impact investing after receiving a message that contains both weak (e.g., impact-related) arguments and strong (e.g., financial return–related) arguments compared with a message that contains the stronger arguments only.

The authors propose the following insights/solutions (based on the social psychology and consumer psychology literature):

- Avoid the goal dilution effect by reducing the number of goals that are simultaneously pursued—preferably to one or by prioritizing one goal over others by giving up or deferring some goals. Specifically, for investing: know your investors’mindsets and priorities and segmenting them into groups based on the number and nature of their values

- Reducing the perceived competition or conflict among goals or increasing perceived goal similarity can weaken the dilution effect and increase the adoption of multiple goals: the more that making money and doing good are perceived as aligned or synergistic, the more investors are likely to embrace impact investing.

- Increase the perception of progress toward the primary goal

- Work on the mood because individuals’ incidental moods alter their perceptions of multipurpose products. For the investing case: when the provider decides to focus on a key goal, the provider should distinguish informational appeals from emotional appeals

- Inform or remind investors (or managers) at the right time that they have subconscious biases; being aware of their biases, is our best defence to reduce the impact of them

- Present easy-to-understand and well-organized information: the multidimensional nature of impact investments can expose would-be impact investors to information overload and lead them to overemphasize the financial dimension in order to simplify their decisions. For example, labeling the impacts of an investment “collateral results” or “side effects,” not necessarily “main goals,” could reduce the influence of the dual goal problem for profit-minded investors.

- Use a “bucket approach” inspired by the mental accounting concept (Thaler 1999). Goal-based compartmentalization means placing investments in a series of buckets, each connected to a specific goal with its own time horizon and risk profile. The idea is that clients may tolerate (expectations of) lower financial returns for the impact-oriented bucket, or they may have longer horizons for their impact investing, especially during times of market volatility.

Why does it matter?

This paper is important because it discusses why perceptions frequently differ from reality by emphasizing the role of subconscious biases in impact investors. Some insights and solutions to overcome biases are proposed accordingly.

The Most Important Chart from the Paper:

Abstract

A cornerstone of impact investing is the intentional provision of measurable nonfinancial returns in addition to conventional financial returns. This attractive promise also constitutes the Achilles’ heel of impact investing. When two or more goals (e.g., impact and financial returns) are pursued through a single means (e.g., investing), humans tend to believe that the means becomes less effective in achieving either goal. We discuss the conceptual foundations of this likely bias and its implications for the impact investing movement. We also suggest some practical ways to overcome this issue.