The Economics of the Fed Put

- Anna Cieslak and Annette Vissing-Jorgensen

- The Review of Financial Studies

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

The question of whether or not the FED considers or responds to the stock market in its policy decisions has been studied fairly extensively, however, the subject of the existence of the “FED put” continues to pop up in the literature. In this particular revival of the issue, the authors are among the first to study FOMC minutes, transcripts, and other sources of information using textual analysis in order to provide an answer to the question:

Does the FED respond to stock market events and if it does, what is the nature of the response?

The authors analyze the period from the mid-1990s to 2016. Their rationale for excluding previous periods is explained in this quote:

While it is difficult to point to one break-date event, several facts related to the Fed’s internal modeling and its public communication make 1994 a plausible demarcation line for our analysis. In terms of internal modeling, major modifications to the Fed’s models took place following the 1991 recession. By around 1993, it became clear that the models in use at that time were unable to explain the slow recovery and its relationship with the “financial headwinds” (Reifschneider, Stockton, and Wilcox, 1997).5 The new FRB/U.S. model became fully operational in mid-1996 (Brayton and Tinsley, 1996), with its key innovation to incorporate expectation formation and intertemporal decision-making of households and firms. In terms of communication, with the first meeting in 1994, the FOMC began making public announcements of their decisions. This moment coincides with a switch from quite frequent to rare intermeeting target moves before and after 1994, implying a change in the Fed’s reaction to events in the intermeeting period. Together, these developments suggest that the mid-1990s was a period of significant changes to the way Fed policy was conducted.

What are the Academic Insights?

- Using textual analysis of FOMC minutes and transcripts the authors find evidence for a number empirical “facts” that describe the relationship between FED policy and stock market conditions.

- The FED “put” appears to be a pattern. Since the mid-90s, the FED has followed with accommodative policy when the stock market has declined substantially during intermeeting periods.

- Stock returns that occur during the intermeeting periods are strongly associated with updates to FED expectations for output growth and unemployment but only weakly associated with expectations for inflation.

- There is an asymmetry in that the association is strong for negative stock returns but not so for positive returns. Negative returns are correlated with FED downgrades of growth and therefore predict changes in the FF target rate.

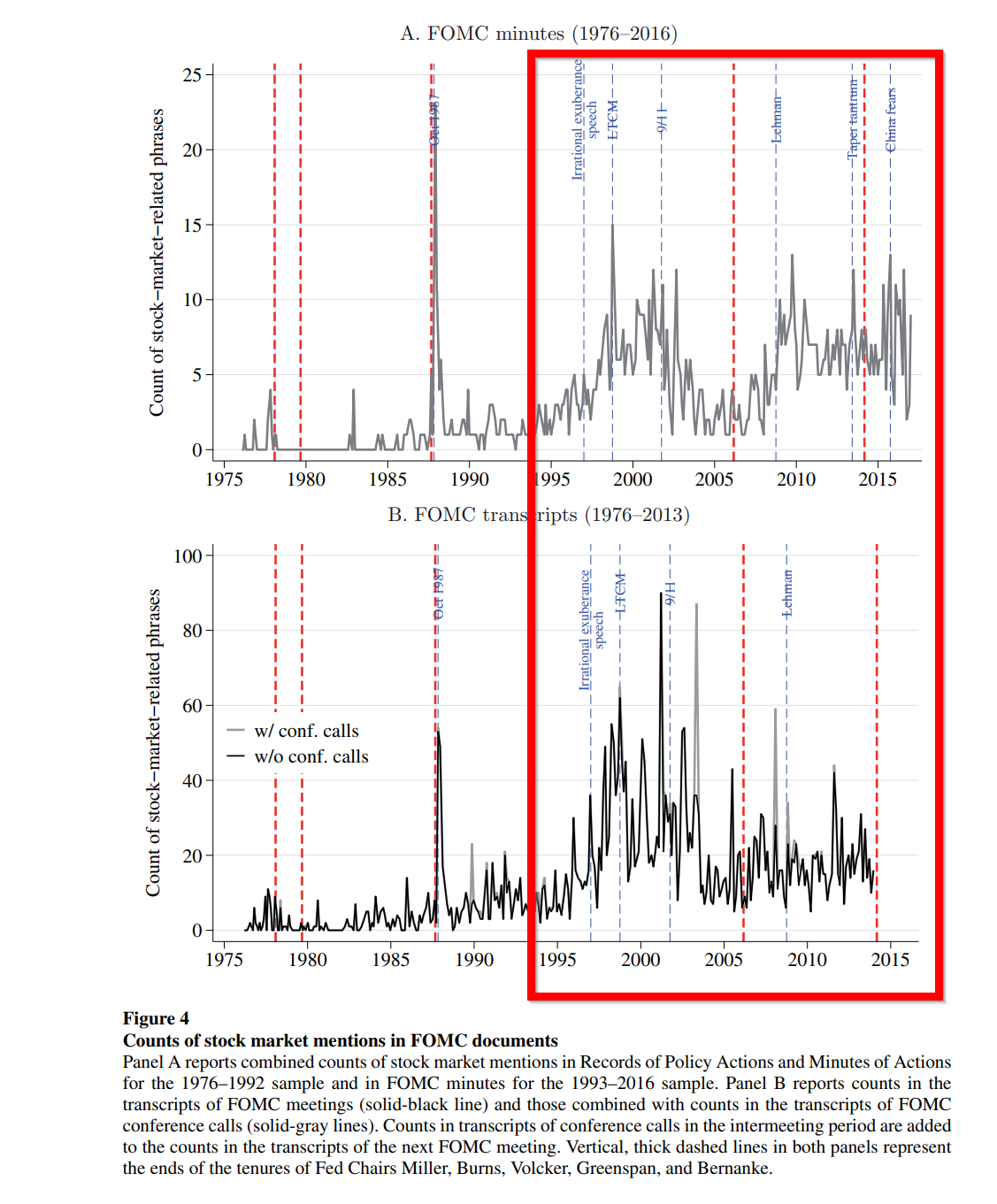

- From the FED’s standpoint, the market is an important source of information. No surprise there. Over the period 1994-2016, textual analysis found 975 mentions of the “stock market, equity prices, S&P500” in 184 FOMC minutes in 24% of inflation and 33% of unemployment comments. Captures of the tone, both positive and negative, of the comments were as expected. High (low) markets led to more positive (negative) comments.

- What exactly is the FED’s view of the stock market? Is it a driver of economic conditions or does it simply predict economic conditions of growth, unemployment and so on? Analysis of the FED minutes revealed that 38% of comments about the stock market aligned with the driver role primarily via the wealth effect of the market on consumption (22%). The investment channel exhibited a much smaller role. Of the remainder of the mentions, 8% with the prediction role 11% of comments are discussions of market determinants and 38% are simple descriptions of market movements.

Why does it matter?

The structure and format of the minutes and transcripts published by the FED provide a unique opportunity to sample the real-time behavior of FED decision-makers or participants. Using advanced textual analysis of those documents, the authors establish a number of empirical facts describing the nature of the relationship between US equity markets the Federal Reserve. The results reported were robust relative to FED minutes and to FED transcripts.

The most important chart from the paper

Abstract

Since the mid-1990s, negative stock returns comove with downgrades to the Fed’s growth expectations and predict policy accommodations. Textual analysis of FOMC documents reveals that policy makers pay attention to the stock market. The primary mechanism is their concern with the consumption wealth effect, with a secondary role for the market predicting the economy. We find little evidence of the Fed overreacting to the market in an ex post sense (reacting beyond the market’s effect on growth expectations). Although policy makers are aware that the Fed put could induce risk-taking, moral hazard considerations appear not to significantly affect their decision-making ex-ante.