E-Commerce During Covid: Stylized Facts from 47 Economies

- Joel Alcedo, Alberto Cavallo, Bricklin Dwyer, Prachi Mishra, and Antonio Spilimbergo

- IMF working paper

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

When the global COVID-19 pandemic hit in early 2020 imposing lockdowns, which limited physical retail purchases, there was a sudden surge in e-commerce. This paper is the first to analyze and quantify the magnitude and the persistence of these effects.

- The authors of this study ask the following:

- How much did the digitalization of consumption increase during this period?

- Did the shock allow economies with low e-commerce penetration to catch up, or did it increase the digital divide?

- Was the increase a transient blip or a permanent increase in levels or trends?

- Which factors can explain differences across economies and sectors?

What are the Academic Insights?

By studying a database provided by Mastercard © comprising 47 economies and 26 sectors for the period between January 2018 and September 2021, the authors find:

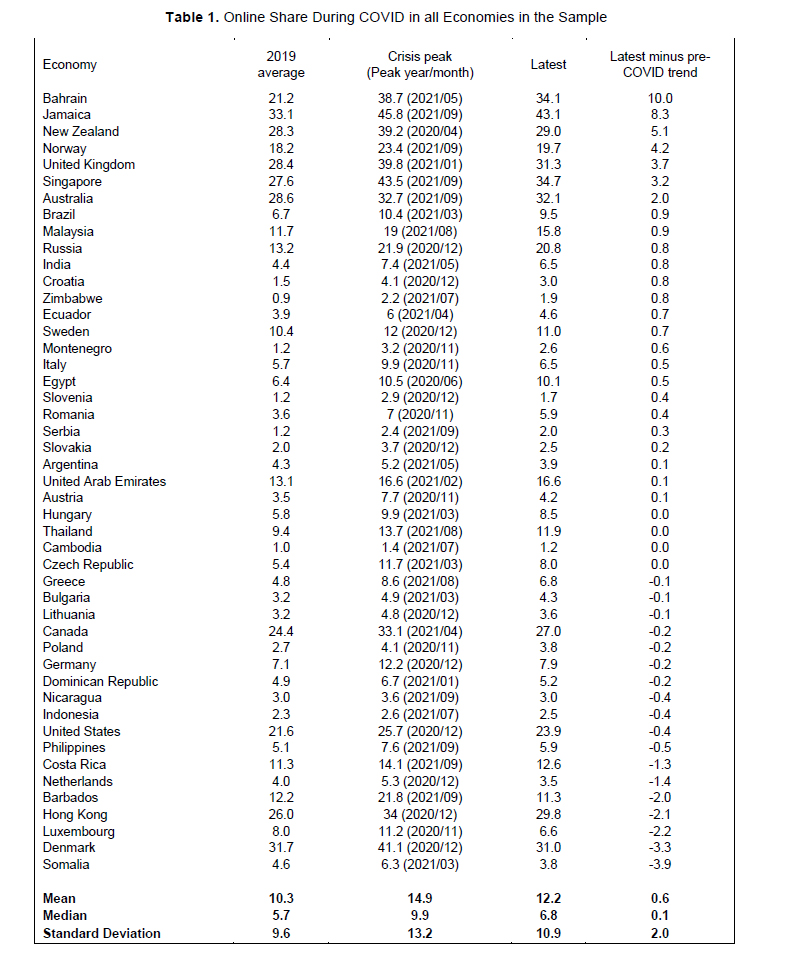

- It depends. The share of online spending differs significantly across economies. For example, in the United States, it peaked shortly after the pandemic started, rising from 13.9% to 17.7%. This share rose again towards the end of the year (when the economy was facing a third wave of COVID cases) and then fell to reach the 15% level predicted by the pre-COVID trend by May 2021. By contrast, in Brazil, the online share initially had a similar pattern but peaked in early 2021 and remained significantly above the level predicted by the pre-COVID trend after more than 18 months of the pandemic. On average, the online share rose from 10.3% in 2019 to 14.9% at the peak and then fell to 12.2% in 2021. Although this level is nearly 2 percentage points higher than before the pandemic started, it is only 0.6 percentage points above the average level predicted by pre-pandemic trends. Table 1 below shows the details of the 47 economies.

- The pandemic increased the digital divide.

- Despite the unprecedented COVID-19 shock, much of the increase in online shares at an economic level appears to be a transitory phenomenon.

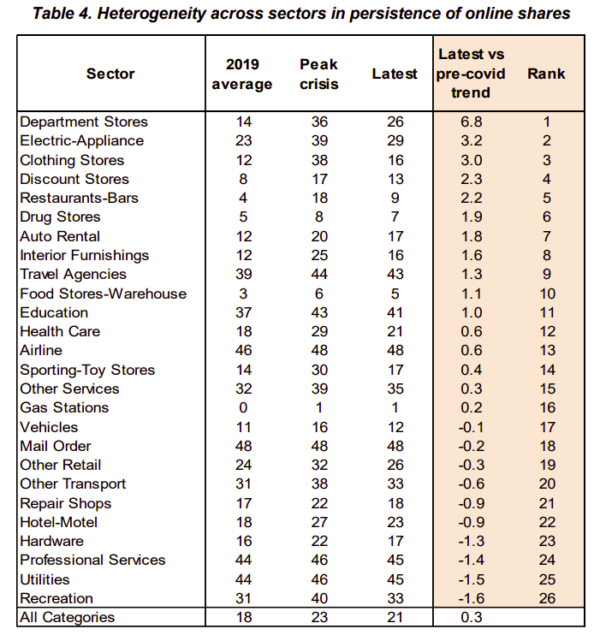

- There is a strong correlation between the economies’ online shares and the strictness of the COVID-19 pandemic movement restrictions, as measured with Google’s index of residential mobility. This was particularly true at the beginning of the crisis in the second quarter of 2020 when the lockdowns severely restricted mobility in most economies, but it has been declining recently. As far as sectors, the most impacted were department stores, clothing stores, restaurants, and bars (see Table 4 below for details). Despite the sharp acceleration, the effects appear to be transitory with exceptions in sectors such as restaurants & bars, retail, and healthcare

Why does it matter?

This paper documents the extent of the e-commerce surge in a systematic and comparable way, using a unique, large dataset covering 47 economies and 26 sectors. While the press tells the story that the pandemic accelerated the trend toward digitalization, forcing people to learn new digital skills, this paper’s results support the quick uptake of e-commerce, but not the persistence of utilization with the exception of a few sectors.

The Most Important Chart from the Paper:

Abstract

We study e-commerce across 47 economies and 26 industries during the COVID-19 pandemic using aggregated and anonymized transaction-level data from Mastercard, scaled to represent total consumer spending. The share of online transactions in total consumption increased more in economies with higher pre-pandemic e-commerce shares, exacerbating the digital divide across economies. Overall, the latest data suggest that these spikes in online spending shares are dissipating at the aggregate level, though there is variation across industries. In particular, the share of online spending in professional services and recreation has fallen below its pre-pandemic trend, but we observe a longer-lasting shift to digital in retail and restaurants.