The Future of Factor Investing

- Dimitris Melas

- Journal of Portfolio Management

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

In this article, the authors expound on the importance of the factor “revolution” in finance. Factor investing has moved from a bedrock position to a future of innovation and disruption. With respect to factors the authors discuss where we have been and what can we look forward to.

What are the Academic Insights?

- At the most basic level, factors have been at the center of modern portfolio theory and management for decades (see here for the history on factor investing). At the outset, factor models most comprehensively represented the risk and return performance for investments in portfolios, as well as single securities. However, as time has moved forward, factors and factor models have taken on a dynamic quality. As the capital markets have evolved, factor investing has changed as a result of advances in academic theory, more and better data, and most importantly, the growing comprehension of the sources of risk and return by investors.

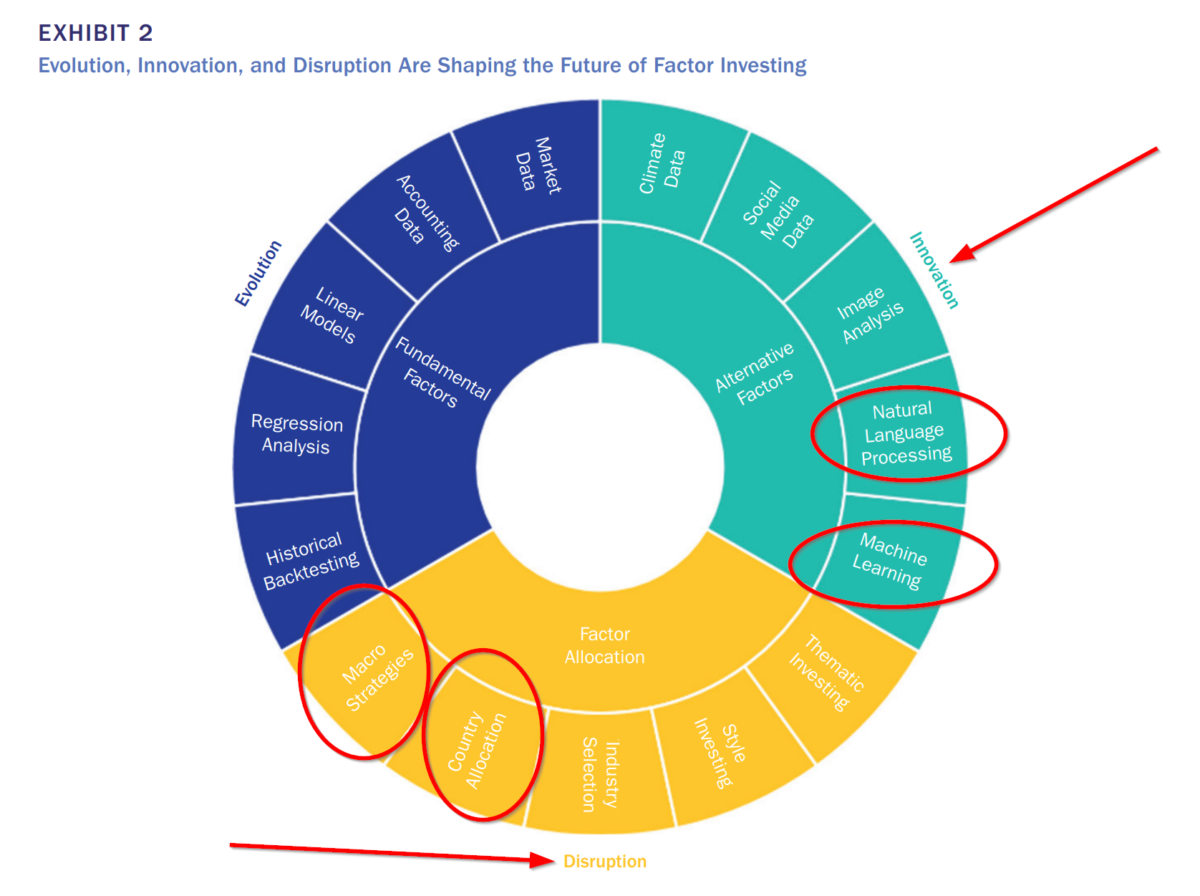

The current state of affairs for factor investing replaced quite a long and entrenched tradition of focusing on stock characteristics and their relative level of mispricing or intrinsic value. This meant that analysts scrutinized individual securities one by one and included them in portfolios based on their specific merits and attributes. The switch to diversified portfolios from individual stocks became increasingly attractive as the factor revolution gained respectability. The respectability came in the form of theoretical developments in fundamental factors which could also be captured with econometrics. Notably, Barr Rosenberg (1974) developed the first real commercial factor model capable of identifying and managing portfolio (factor) risks. In terms of a revolutionary impact on investment practice, the commercialization (BARRA) of portfolio optimizers driven by factor models did more for factor investing than any other development that I can think of. In the end, the success of factor investing is due to three elements: strong academic theory, rigorous empirical analysis, and investment practice that reflects factor fundamentals. - But have factors become relics? A thing of the past? Not at all. In spite of the recent poor performance of value strategies, factors now matter as much as they ever have. The academic and practitioner research is currently focused on refining and consolidating a parsimonious set of factors and developing more efficient portfolio construction approaches. An examination of Exhibit 2 will provide the reader with a quick summary of the evolution of factor models and their applications. Beyond simple enhancements, the field is currently innovating in two areas: the use of new modeling and econometric approaches and the use of alternative data sets.

The alternative sets of data have the potential to provide new signals and sources of information. Natural language processing, machine learning, nonlinear models, cloud computing, and textual analysis have been deployed to capture new investment ideas, content, and themes. For example, new data sets with atypical formats such as text, audio, and video obtained from social media are common. Next on the factor agenda is developing expertise with unstructured data found in news reports, product reviews, job postings, regulatory filings, call transcripts, satellite images, and so on. All of which have begun to affect the asset allocation process by opening up new investment ideas and themes that investors may use to express new views on active management. Although I would argue that the case for significant disruption is less striking. It goes without saying that the introduction of factor models will disrupt the traditional asset allocation decisions such that investors will certainly be able to embrace new and active views for their portfolios.

Why Does it Matter?

The world is currently consumed with sustainability and climate change. ESG has attained a level of respectability and acceptance as investors have begun to recognize the merits of including the impact of environmental, social, and governance issues in portfolios. Factor models represent the next best answer when considering how far we are from integrating climate and sustainability factors in portfolios.

From the authors:

the climate emergency and the need to transition to a net-zero economy have been recognized as the greatest challenges facing societies and investors this century (Giese, Nagy, and Rauis 2021).

The authors argue quite effectively that factor models could be instrumental in managing climate risk. Citing research to build innovative factors and analytics including climate value at risk, implied temperature rise, and climate-themed relevance scores, the authors predict these types of signals can easily integrate into factor strategies. Meeting a financial target and managing climate risk at the same time is an outcome within reach.

The Most Important Chart from the Paper

Abstract

In this article, the author discusses current structural research and investment trends that are shaping the future of factor investing. Specifically, the author focuses on three emerging trends: the ongoing evolution of traditional factor models and strategies, recent innovation in data sources and modeling techniques, and the potential disruption from integrating factor strategies into the asset allocation process.